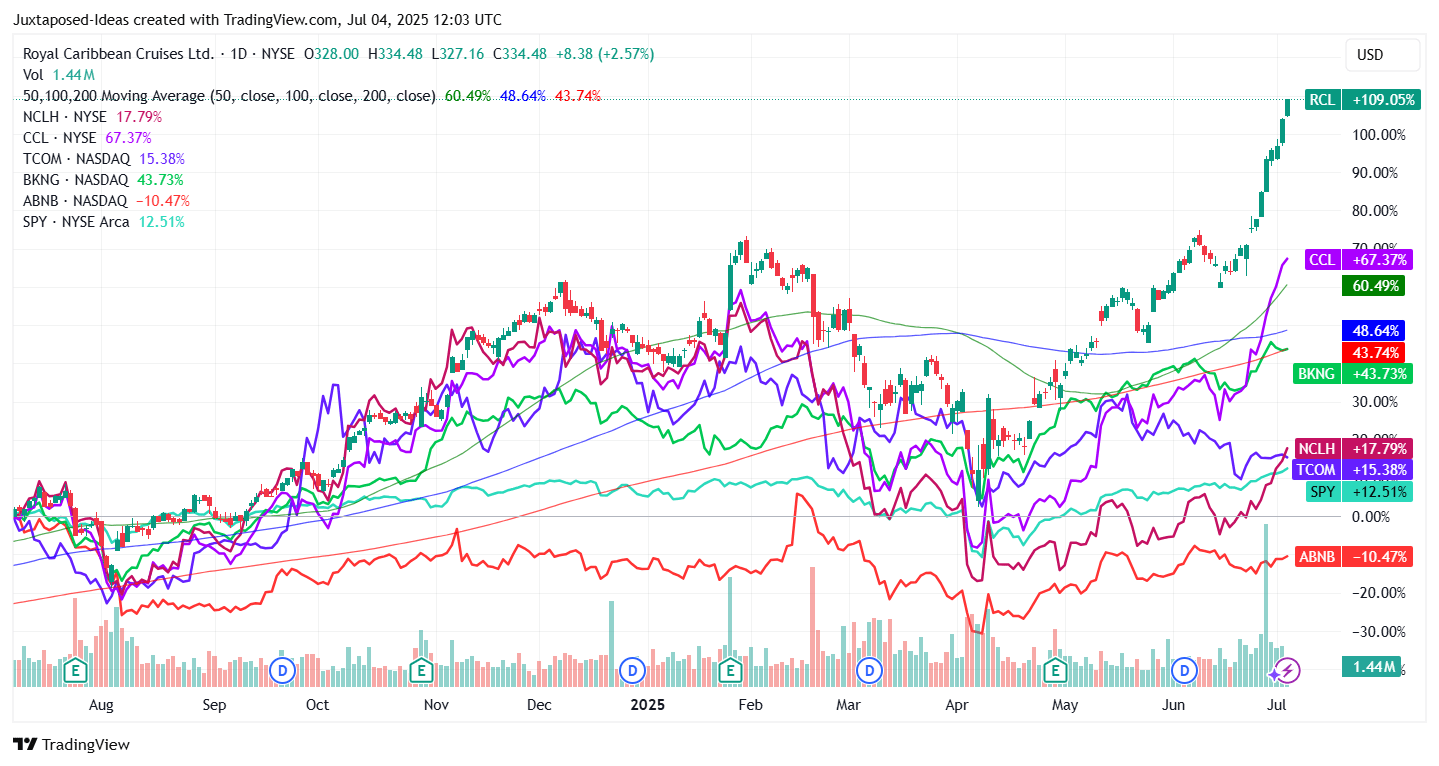

Royal Caribbean Shares Drop 8% After Cautious 2025 Outlook

The pullback shows Wall Street’s impatience with cautious outlooks: even full ships face cost and disruption risks as cruise lines lean on private stops and app-led spending.

Royal Caribbean Group’s shares fell about 8% after the company reported third-quarter 2025 results and issued profit guidance that investors viewed as cautious, even as management pointed to strong demand trends and higher full-year expectations.

For the quarter ended Sept. 30, 2025, the company reported revenue of $5.14 billion and adjusted earnings per share of $5.75. Royal Caribbean lifted its full-year 2025 adjusted EPS outlook to $15.58 to $15.63, but that range still sat slightly below the $15.68 consensus estimate cited in financial coverage, contributing to the sell-off.

Third-quarter performance: profit beat, strong load factors, and rising onboard spend

Royal Caribbean said third-quarter net income was $1.6 billion, or $5.74 per share, and adjusted net income was also $1.6 billion, or $5.75 per share. Adjusted EBITDA was reported at $2.3 billion.

- Demand and capacity: Royal Caribbean reported a load factor of 112% and said capacity rose about 2.9% year over year, with approximately 2.5 million guests carried during the quarter.

- Yields: Gross margin yields rose 3.8% on an as-reported basis, while net yields increased 2.8% as reported and 2.4% in constant currency.

- Costs: Gross cruise costs per available passenger cruise days increased 2.7% year over year, while net cruise costs excluding fuel per available passenger cruise day increased 4.8% as reported and 4.3% in constant currency.

Royal Caribbean attributed performance versus its prior guidance to stronger-than-expected close-in demand and lower costs, while also highlighting increased onboard spending. The company said onboard revenue rose to $1.502 billion in third-quarter 2025 from $1.415 billion in third-quarter 2024.

Guidance update and the issues pressuring near-term expectations

For full-year 2025, Royal Caribbean said its updated adjusted EPS outlook of $15.58 to $15.63 implies 32% year-over-year growth. The company also expects net yields for 2025 to increase 3.5% to 4.0% on both an as-reported and constant-currency basis.

For the fourth quarter of 2025, Royal Caribbean guided adjusted EPS to $2.74 to $2.79. It expects net yields to increase 2.6% to 3.1% as reported (2.2% to 2.7% in constant currency) and forecast net cruise costs excluding fuel per available passenger cruise day to decline 5.7% to 6.2% as reported (6.1% to 6.6% in constant currency).

Management said the improved annual outlook was driven mainly by third-quarter performance, partially offset by a limited fourth-quarter impact tied to adverse weather and an “unplanned extension” of a temporary closure at Labadee, Haiti.

Reuters also highlighted cost pressures the operator is navigating, including higher fuel costs and expenses associated with drydocking, ship deliveries, and maintenance. Separately, Royal Caribbean has pointed to geopolitical uncertainty as a factor that can affect global consumer confidence.

Caribbean deployment strategy, new-ship additions, and shorter itineraries

On the earnings call, CFO Naftali Holtz described the Caribbean as a core region for the company’s deployment. The Caribbean accounted for 57% of deployments in 2025 and 63% of capacity in the fourth quarter, he said.

Holtz said Royal Caribbean’s Caribbean capacity is up 6% for the year and expected to be up 10% in the fourth quarter, with fourth-quarter Caribbean yields expected to be up 37% compared with the fourth quarter of 2019.

“As expected, capacity growth in the fourth quarter is driven by new ships, the Star of the Seas and Celebrity Xcel, as well as additional APCDs due to lower drydock days compared to 2024,” Holtz said.

Looking to 2026, Holtz said the Caribbean is expected to represent about 57% of deployment, and he noted the company has continued adding shorter itineraries following recent performance trends.

Private destinations: Santorini announcement and a broader pipeline

Royal Caribbean announced Royal Beach Club Santorini, which President and CEO Jason Liberty said is scheduled to open in 2026. Liberty said the project supports a plan to expand the company’s land-based destination portfolio from two to eight by 2028.

The company has also highlighted other destination initiatives, including Royal Beach Club Paradise Island and Perfect Day Mexico, as it builds out private and exclusive access experiences tied to its itineraries.

Digital commerce becomes a bigger part of pre-cruise and onboard revenue

Executives also emphasized how digital channels have become central to guest engagement and spending. Royal Caribbean’s app, launched in 2017 to improve the boarding experience, has evolved into a broader commerce and operational tool.

“The app, together with our e-commerce engines, has evolved into a cornerstone for our e-commerce strategy,” Liberty said on the earnings call.

Royal Caribbean reported that about 50% of onboard revenue in the third quarter was booked pre-cruise, and nearly 90% of those pre-cruise transactions were completed through digital channels. Separately, the company said a record 90% of pre-cruise purchases are now booked through digital platforms.

What executives and outside observers said about demand and the path into 2026

Liberty said demand and guest satisfaction remain strong. “We continue to see strong momentum across our business, powered by accelerated demand, growing loyalty, and guest satisfaction that is at all-time highs,” he said.

He also tied strategy to the company’s ships, destinations, and brands. “Our commercial flywheel - combining innovative ships, distinctive destinations, and world-class brands - continues to drive sustained growth,” Liberty said.

Looking beyond 2025, Liberty pointed to the booking position and cost discipline as a foundation for confidence in the next year. “With our proven formula of moderate yield growth, strong cost controls, and disciplined capital allocation, we expect 2026 earnings per share to have a 17 handle,” he said, while also referencing the company’s longer-range “Perfecta” targets.

On Yahoo Finance’s Opening Bid Unfiltered podcast, former Royal Caribbean CEO Richard Fain, who led the company from 1988 to 2022 and remains chairman, described the trade-offs behind long-term investments. “I’m willing to accept short-term costs for an amazing long-term future,” Fain said.

After the results, Melius Research’s Conor Cunningham wrote that “the algo of moderate capacity growth moderate yield growth and cost execution is working,” and pointed to a view that the company’s 2026 baseline could still allow upside.

In a separate Reuters interview, Robert Pavlik, senior portfolio manager at Dakota Wealth, said: “Cruise operators may also be seeing pressure due to the government shutdown affecting port activity.” Reuters also cited Michael Gunther of Consumer Edge as saying, “Cruises continue to outperform most other travel and leisure categories,” while adding that growth was “particularly robust” among households with income between $100,000 and $150,000 annually.

Royal Caribbean’s next milestones include delivering on its fourth-quarter 2025 guidance, navigating weather- and destination-related disruptions, and executing planned capacity and destination additions, including Royal Beach Club Santorini’s expected 2026 opening.

Frequently Asked Questions (FAQs)

Why did Royal Caribbean stock fall after its third-quarter 2025 report?

Coverage attributed the drop to revenue coming in slightly below expectations and to near-term profit guidance that, while raised, was still below the consensus estimate referenced in market coverage. Royal Caribbean reported revenue of $5.14 billion, while Bloomberg data cited in coverage put estimates around $5.17 billion, and its full-year 2025 adjusted EPS range of $15.58 to $15.63 remained below the $15.68 consensus estimate cited in financial coverage.

What were Royal Caribbean’s key third-quarter 2025 financial results?

For the quarter ended Sept. 30, 2025, Royal Caribbean reported revenue of $5.14 billion and adjusted EPS of $5.75. It also reported net income of $1.6 billion, or $5.74 per share, and adjusted EBITDA of $2.3 billion.

What guidance did Royal Caribbean provide for full-year 2025 and the fourth quarter of 2025?

The company raised its full-year 2025 adjusted EPS outlook to $15.58 to $15.63 and said it expects net yields for 2025 to increase 3.5% to 4.0%. For the fourth quarter of 2025, it guided adjusted EPS to $2.74 to $2.79 and said net yields are expected to increase 2.6% to 3.1% as reported (2.2% to 2.7% in constant currency).

What is Royal Beach Club Santorini, and when is it expected to open?

Royal Beach Club Santorini is a newly announced Royal Caribbean land-based destination project that CEO Jason Liberty said is scheduled to open in 2026. Liberty also said it supports a plan to grow the company’s land-based destination portfolio from two to eight by 2028.

How is Royal Caribbean using its app and digital channels to drive revenue?

Royal Caribbean said nearly 90% of pre-cruise transactions were completed through digital channels, and it reported that about 50% of onboard revenue in the third quarter was booked pre-cruise. The company also disclosed that onboard revenue increased to $1.502 billion in third-quarter 2025 from $1.415 billion in third-quarter 2024.