Moody's Upgrades Carnival Credit Rating After Record Q2

Moody’s upgrade reflects Carnival’s strong recovery, as robust earnings, liquidity measures, and operational efficiencies signal growing stability for the broader cruise sector.

Moody's recent decision to upgrade Carnival Corporation's credit rating from B1 to Ba3 marks a significant step in the cruise industry's ongoing recovery, driven by Carnival's improved leverage, robust liquidity, and resilient passenger demand. The company's record second-quarter 2025 financial results and strategic refinancing initiatives underscore stronger investor confidence in the cruise sector's post-pandemic trajectory.

Moody's Credit Rating Upgrade

The upgrade, announced following a detailed review of Carnival's financial performance, reflects positive trends in key credit metrics. Moody's highlighted a declining Debt/EBITDA ratio (4.6x as of November 2024, with projections near 4.0x in 2025 and approximately 3.5x in 2026) and healthy free cash flow of around $1.6 billion expected for 2025. Analysts also pointed to Carnival's scale, which spans nine cruise brands and a 40% global market share, as a stabilizing factor amid fuel price volatility and evolving regional demand.

Earlier this year, Carnival reported $1.2 billion in cash reserves. In June, the company expanded its revolving credit facility to $4.5 billion, a 50% increase over previous levels. These actions bolstered Moody's assessment of the company's liquidity, reducing refinancing risk and supporting continued balance-sheet repair.

Record Revenues and Q2 2025 Performance

Carnival posted its highest-ever second-quarter revenues in 2025, hitting $6.3 billion, up nearly $550 million from the prior year. Net income reached $565 million, while adjusted EBITDA stood at $1.5 billion, representing a major gain compared to 2024. Customer deposits also climbed to a historic $8.5 billion, indicating a robust bookings pace and strong onboard spending.

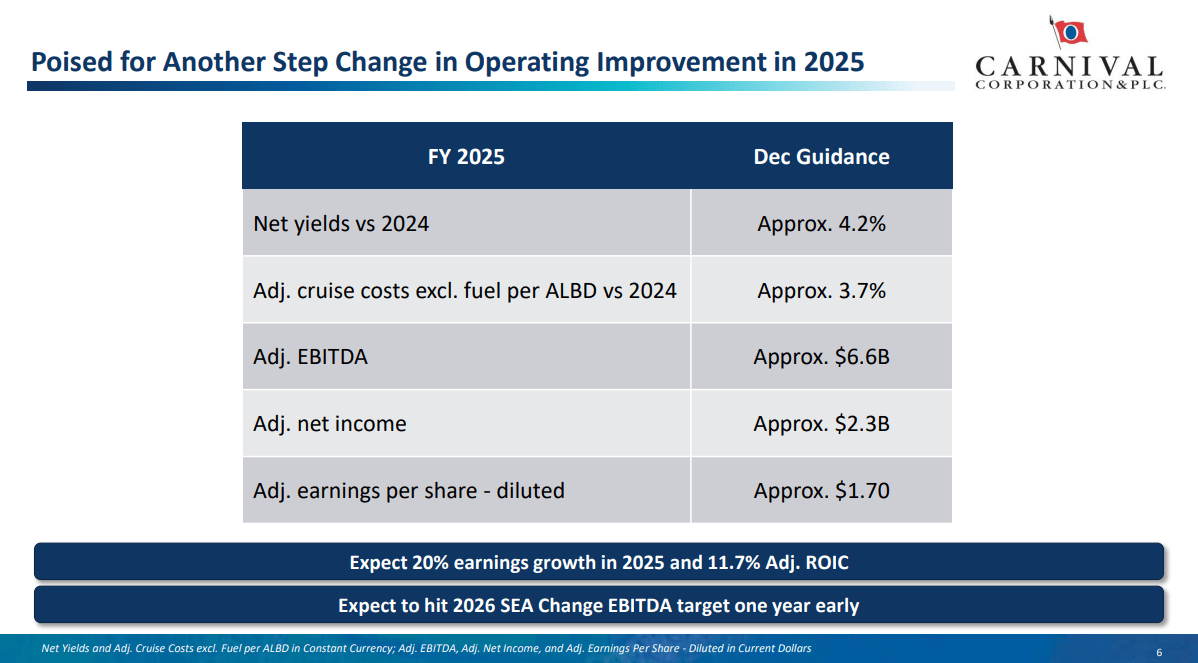

In its Q2 2025 update, Carnival stated it delivered a phenomenal quarter on the back of “record net yields and strong demand” and remains on track for strong growth in the second half of the year. The company also reported surpassing its 2026 SEA Change financial targets a full 18 months ahead of schedule.

Liquidity and Refinancing

To support its future growth and further solidify its credit position, Carnival refinanced nearly $7 billion in debt at favorable rates in 2025. These actions, combined with the larger revolver, significantly reduced interest expenses and enhanced financial flexibility. Analysts suggest the company is edging closer to investment-grade territory, contingent on continued deleveraging and stable consumer demand.

Operational Efficiency and Strategic Positioning

Carnival has maintained a 40% market share worldwide, with major brands such as Carnival Cruise Line, Princess Cruises, and Holland America Line serving diverse markets across Europe, Asia, and the Americas. Over the near term, the company plans a slower pace of capacity expansion, supporting price stability and yields. Fleet growth includes eight new ships in the pipeline through 2033, though the company continues to manage ship introductions cautiously to avoid oversupply.

Efficiency measures remain a priority, evidenced by a reported 6.3% reduction in fuel consumption per available lower berth day. This move supports cost control amid rising fuel prices and broader cost inflation. Onboard spending, bolstered by Carnival's wide-ranging product offerings, remains strong, contributing to record net yields in 2025.

Risks and Market Challenges

Despite the upbeat outlook, the cruise sector still faces potential headwinds. Volatile fuel prices could pressure margins if cost offsets lag. Competitive capacity growth in popular regions like the Caribbean may affect seasonal pricing, and a broader economic slowdown could dampen discretionary spending on travel. However, Carnival's scale and flexible itineraries offer resilience, helping the company adapt if demand shifts geographically or seasonally.

Economic Implications and Outlook

Carnival's strong second-quarter performance and the subsequent credit rating upgrade reinforce broader optimism in the cruise industry's ability to navigate post-pandemic challenges. Analysts predict the company’s Debt/EBITDA ratio could reach 3.5x by 2026, further strengthening its financial profile. Meanwhile, Carnival’s stock, recently trading near $32.50, continues to draw interest from investors who see upside potential, with some valuations ranging from $50 to $65 per share. As long as the company maintains momentum in earnings growth, capacity management, and liquidity, it appears well positioned to capitalize on the travel rebound.

Frequently Asked Questions (FAQs)

What led to Carnival's credit rating upgrade?

Moody's raised Carnival's rating from B1 to Ba3 based on improving leverage, robust free cash flow forecasts, and ample liquidity. The ratings agency also cited Carnival's 40% global market share, which helps stabilize operations across regions.

How has Carnival achieved record revenues?

The company leveraged operational efficiencies, lowered fuel consumption, and maintained strong onboard spending. Coupled with a steady bookings pace, these factors led to $6.3 billion in second-quarter 2025 revenues, a record for Carnival.

What official statement did Carnival provide regarding its Q2 2025 performance?

In its report, Carnival described Q2 2025 as a phenomenal quarter driven by record net yields and strong demand, adding that it surpassed its 2026 SEA Change financial targets 18 months early. It also anticipates continued growth in the latter half of 2025.

What are the key risks to Carnival's outlook?

Carnival faces potential pressures from rising fuel costs, inflation, and competitive capacity growth, particularly in the Caribbean. A broader economic slowdown could also impact consumer spending on travel, though Carnival's global presence helps mitigate regional downturns.

How strong is Carnival's liquidity position?

Carnival recently boosted its revolving credit facility to $4.5 billion, refinanced around $7 billion in debt under favorable terms, and holds significant cash reserves. These measures reduce refinancing risk and enhance the company's capital flexibility for future investments.

With continued emphasis on strategic capacity management, efficient cost controls, and proactive financing, Carnival looks set to maintain its industry leadership as cruising recovers worldwide. As the company enters the latter half of 2025, steady revenue growth, loyal customer demand, and an expanded credit facility all point toward sustained momentum for the cruise sector's largest operator.