Carnival Restores Quarterly Dividend at 15 Cents a Share

Carnival’s dividend comeback signals the cruise industry’s shift from pandemic survival to cash returns as demand holds and balance sheets repair, reshaping investor expectations.

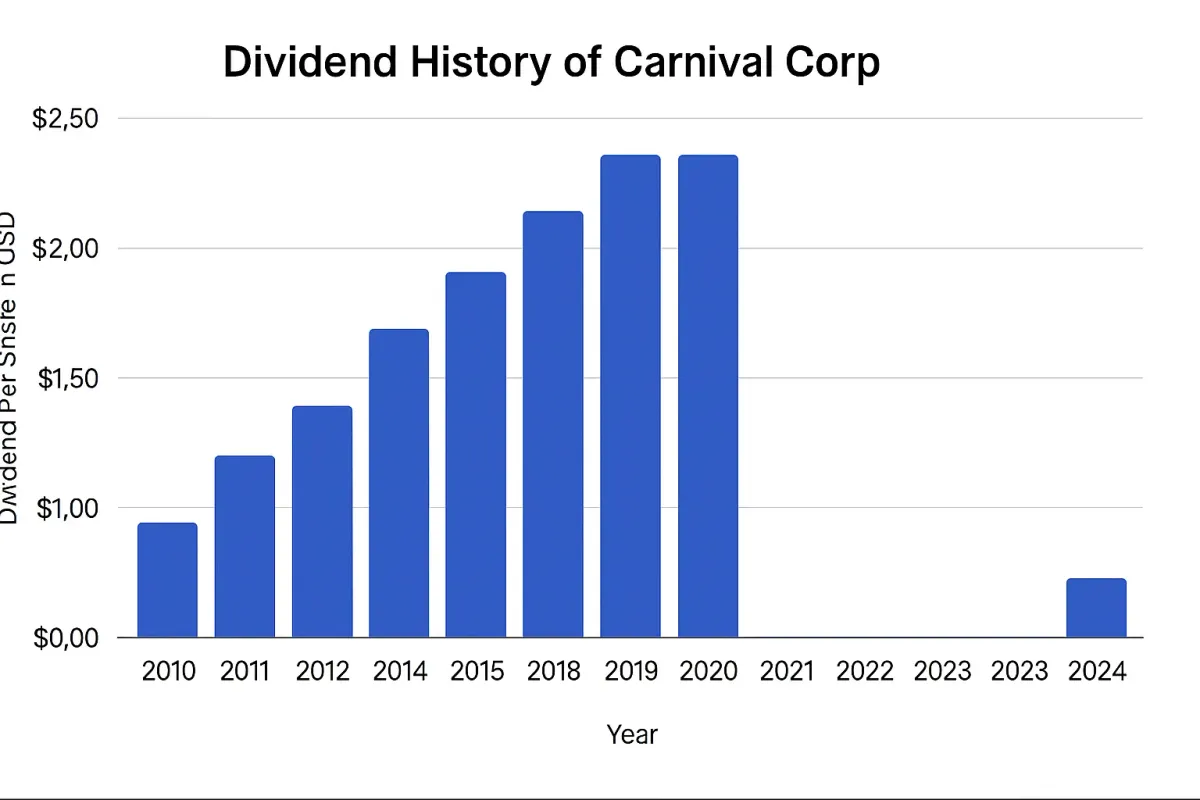

Carnival Corporation & plc is reinstating its quarterly dividend for the first time since the early months of the Covid-19 pandemic, setting an initial payout of $0.15 per share after suspending dividends in April 2020. The dividend will be paid Feb. 27, 2026, to shareholders of record as of Feb. 13, 2026.

The company tied the move to improved financial results and balance-sheet progress after a multiyear recovery effort. Shareholders last received a payout in February 2020.

How Carnival framed the dividend’s return

Chief Financial Officer David Bernstein linked the decision to leverage and refinancing milestones reached in 2025. “We have reached a meaningful turning point,” Bernstein said, citing “a net debt to adjusted EBITDA ratio of 3.4x for 2025” and the completion of “our $19 billion refinancing plan in less than a year.”

Chief Executive Officer Josh Weinstein also pointed to a broader set of achievements during the year, saying: “We set new records across our business, achieved investment grade leverage metrics and, as announced just today, reinstated our dividend.”

Record 2025 performance helped underpin the decision

Carnival reported full-year net income of $2.8 billion on record revenues of $26.6 billion, alongside full-year operating income of $4.5 billion, up 25% compared with the prior year. For the fourth quarter of 2025, the company posted net income of $422 million, nearly 40% higher than the same period in 2024, and said adjusted net income was $454 million, outperforming guidance by more than $150 million.

- The company reported fourth-quarter revenue of $6.3 billion, which it said was a quarterly record and about $400 million higher than the prior year.

- Adjusted EBITDA for the quarter was a record $1.5 billion, with adjusted EBITDA margins up nearly 300 basis points year over year.

- In constant currency, net yields were up 5.4% year over year in the quarter, while gross margin yields were reported as 16% higher than 2024.

- On costs and fuel efficiency, cruise costs per available lower berth day (ALBD) increased 2.2% versus 2024, while adjusted cruise costs excluding fuel per ALBD rose 0.5% in constant currency and fuel consumption per ALBD decreased 5.6%.

Weinstein attributed the 2025 performance to demand and cost controls, saying, “With our strengthened balance sheet and a powerful portfolio of cruise lines, we are well-positioned to continue driving exceptional returns and delivering value to our shareholders.”

Balance-sheet actions, credit ratings, and recent financings

Management emphasized debt reduction and credit improvement as central to the company’s ability to return cash to shareholders. Bernstein said Carnival reduced debt by more than $10 billion from its peak less than three years ago, and he highlighted multiple credit rating upgrades during 2025 that “culminated in reaching investment grade with Fitch,” while S&P was described as “one notch away” with a positive outlook.

In recent financing activity, the company issued $1.25 billion of senior unsecured notes at 5.125% due 2029 and entered into two $250 million loans due 2027, then used the combined proceeds, along with cash on hand, to repay $2.0 billion of debt.

Carnival also said that on Dec. 5, 2025, it redeemed outstanding convertible notes and settled conversions with a combination of $500 million in cash and 69 million common shares, which it said was 18 million fewer shares than would have been required under an all-equity settlement.

Demand signals: deposits and booking trends into 2026 and 2027

Carnival ended the quarter with record customer deposits of $7.2 billion as of November 2025, surpassing the prior fourth-quarter record set at Nov. 30, 2024. The company also reported elevated booking volumes across 2026 and 2027 itineraries, including record booking volumes for 2026 and 2027 sailings over the last three months and higher volumes from Black Friday through Cyber Monday compared with the prior year.

Weinstein said the company entered the new fiscal year with strong early-positioned demand, noting it is at “our highest booked occupancy for the upcoming year at about two-thirds booked at higher prices.” He added that booking prices in constant currency were at historical highs in both North America and Europe.

What Carnival is forecasting for 2026

For full-year 2026, Carnival forecast adjusted net income of about $3.5 billion, a level the company said would exceed 2025 results and reflect approximately 12% year-over-year growth on less than 1% capacity growth. It also guided to net yields in constant currency increasing about 2.5% versus 2025, or about 3.0% after normalizing for accounting treatment tied to Carnival Cruise Line’s new loyalty program and redeployments from the Arabian Gulf.

On costs, Carnival said full-year 2026 adjusted cruise costs excluding fuel per ALBD in constant currency are expected to rise about 3.25%, or about 2.5% after normalizing for factors including Celebration Key (Grand Bahama), RelaxAway (Half Moon Cay), and the timing of certain expenses.

For the first quarter of 2026, the company expects net yields in constant currency to increase about 1.6% versus record 2025 levels, or about 2.4% after normalizing for the impact of close-in redeployments from the Arabian Gulf. It also expects adjusted cruise costs excluding fuel per ALBD in constant currency to increase about 5.9% compared with the first quarter of 2025, which it attributed to the timing of certain expenses.

Planned reincorporation in Bermuda and a simplified listing structure

Separately, Carnival has announced plans to legally reincorporate in Bermuda by the second quarter of 2026. The company currently operates under a dual structure with Carnival Corporation listed on the New York Stock Exchange and Carnival plc trading on the London Stock Exchange; it plans to consolidate operations under a Bermuda-domiciled entity, Carnival Corporation Ltd, and maintain a single listing on the New York Stock Exchange.

Carnival said the move is intended to streamline governance, reduce administrative costs, and enhance liquidity and shareholder value, while not changing core operations or commitments in key markets such as the UK. The proposal is subject to shareholder approval in April 2026 and regulatory endorsements, and Carnival said the transition aligns with Bermuda’s alignment to international financial standards.

Operational efficiency and sustainability efforts highlighted alongside results

Alongside the financial update, the company pointed to reduced fuel consumption per ALBD and said it continues to invest in green technologies as it focuses on sustainability and operational efficiency. Carnival also emphasized disciplined cost management across its global fleet of 90 ships as it works toward its 2026 performance targets.

Frequently Asked Questions (FAQs)

What are the record date and payment date for Carnival’s reinstated dividend?

The dividend has a Feb. 13, 2026 record date and is scheduled to be paid Feb. 27, 2026. The initial quarterly dividend amount is $0.15 per share.

How did Carnival link the dividend decision to its balance sheet?

CFO David Bernstein said the company hit “a net debt to adjusted EBITDA ratio of 3.4x for 2025,” completed “our $19 billion refinancing plan in less than a year,” and reduced debt by more than $10 billion from its peak less than three years ago, alongside credit rating upgrades that included investment grade with Fitch.

Why is Carnival planning to reincorporate in Bermuda?

Carnival said the change is designed to streamline governance and reduce administrative costs by consolidating into a single Bermuda-domiciled entity, Carnival Corporation Ltd, with a single listing on the New York Stock Exchange. The proposal is subject to shareholder approval in April 2026 and regulatory endorsements.

What is Carnival’s outlook for 2026?

Carnival forecast full-year 2026 adjusted net income of about $3.5 billion, which it said would represent roughly 12% growth versus 2025 on less than 1% capacity growth. The company also expects net yields in constant currency to rise about 2.5% versus 2025, with additional guidance provided for normalized yields and costs.